It could be argued that measuring, calculating, and understanding Customer Lifetime Value (CLV) is the most important type of customer analysis. A CLV model can have varying levels of sophistication and accuracy, but neglecting CLV might have serious consequences.

Doing it wrong

A cautionary tale about neglecting Customer Lifetime Value comes from Blue Apron. The company delivered its first meal kit in 2012 and grew quickly, launching a successful IPO in 2017. Blue Apron kept up its rapid growth by spending an increasing amount in marketing to attract new customers; however, many customers would stop the service once discounts ran out. By one estimate the company was losing money on 70% of its customers. Blue Apron’s stock over the next two years would shrink to a dismal 4.8% of its IPO value.

We do not need to learn the hard way that CLV matters. Companies that are too keen on growth can forget about the value that comes from retaining loyal customers. This article will shed some light on the value of CLV by explaining what it is and how a business can use it to increase profits.

Doing it right

Nike, on the other hand, has embraced the Customer Lifetime Value model. The sports apparel company in 2018 acquired Zodiac, a customer data analytics company founded by preeminent CLV researchers. The deal occurred while Nike was growing its NikePlus membership program with the hopes of building “life-long relationships with consumers.” And the efforts seem to be working. By the end of 2019, 30% of total sales were direct-to-consumer, a strong indication that Nike is successfully fostering customer loyalty.

Customer purchase history

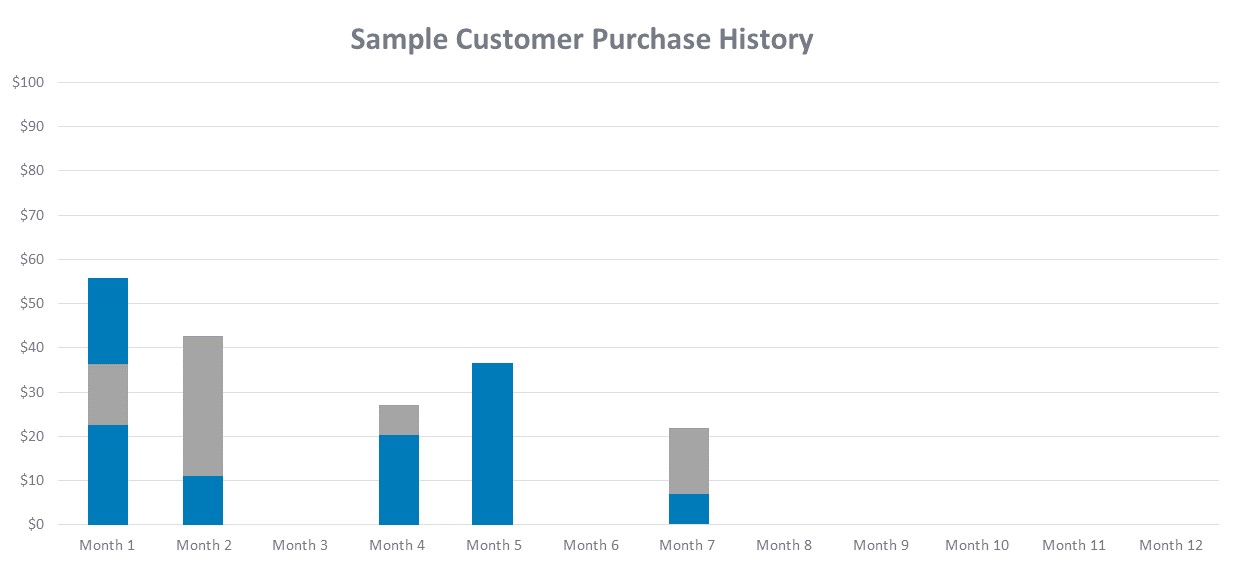

To understand what Customer Lifetime Value is, we first need to know what it is trying to model. CLV is an attempt to take a customer’s purchase history, predict a future stream of purchases, and then bring those future expected sales into a present value. Consider the following hypothetical customer:

We see an individual who shops irregularly with three purchases in Month 1 but no purchases in Month 3. Importantly however, the customer stops buying anything after Month 7, indicating that that the store for an unknown reason lost a customer. We consider the individual “alive” during the first seven months and use that period to calculate the frequency of visits (1.42/month) and average spending ($23.70/purchase).

How to calculate it

Customer Lifetime Value, as the name implies, is attempting to measure an individual. There are a variety of CLV models, including popular the BG/NBD model. As much as I would like to discuss the properties of the associated statistical distributions of the model (seriously though, I love this stuff), I will instead give a high-level overview of what a typical CLV model is trying to represent.

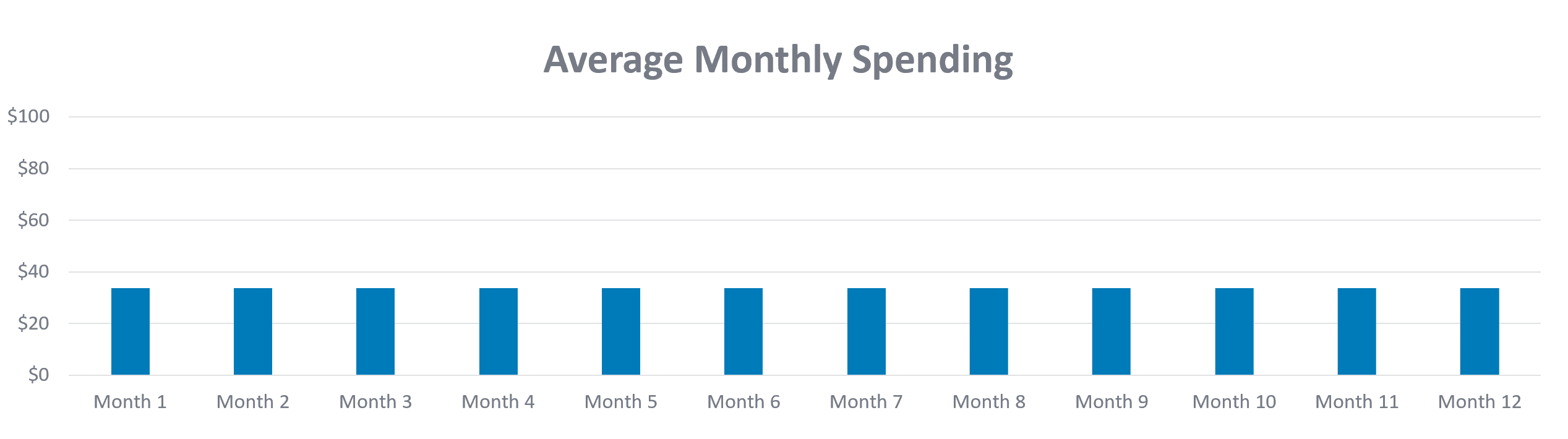

The first major component of a model is to predict average monthly spending (or profit) while a customer is “alive.” This is shown below as a uniform manner with the average spending calculated from the above purchase history.

The second major component is the likelihood that a customer “exits” the model. This represents when a customer no longer shops at a store, such as when they die, move, or simply go to other stores. This often is calculated from the time of the most recent purchase and then decreases exponentially. Here we represent a customer who each month is 95% as likely to make a purchase as the previous month.

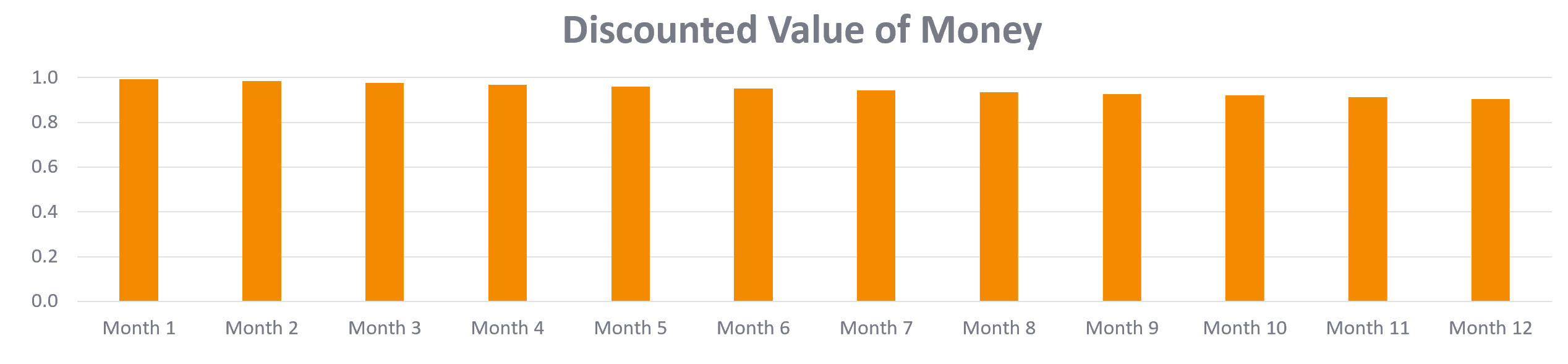

The third component of a CLV model is the time discount of money. This incorporates the concept in finance that a dollar today is worth more than a dollar tomorrow and is why the model refers to lifetime “value” and not lifetime “revenue.” Below we see the value of money discounted by 1% each month.

Multiplying these three together will show the present value of all future expected revenue from a customer. Then adding up all time periods will yield the customer lifetime value to the store.

The value of CLV

Companies that implement a CLV model be able to answer critical business questions, such as:

- What is the value of retaining a specific customer?

- Does the new customer acquisition cost justify an increase in marketing expense?

- Which customers are we at a high risk of losing right now?

- Is a customer loyalty program working?

Whichever question a company is hoping to answer about its customers, the CLV model can provide some useful answers and help drive lifetime profits.